The Ultimate Guide To Business Tax Accountant Utah

Table of ContentsBusiness Tax Accountant Utah Can Be Fun For AnyoneBusiness Tax Accountant Utah for BeginnersThe smart Trick of Business Tax Accountant Utah That Nobody is Talking About10 Easy Facts About Business Tax Accountant Utah Shown

You can choose a CPA based on the complying with standards: service area, market and also services. Is the Certified Public Accountant certified to practice in your state? To what professional companies does the CPA belong, and also how energetic is he or she in those organizations?

As a result, when seeking a CPA, you need to assess your existing as well as future monetary needs and pick a person that can resolve your specific issues. CPAs themselves have some pointers on just how you can make the finest use of audit solutions and obtain the most value for your fee (business tax accountant utah). Here are just a few of them: Be ready to review your plans as well as goals.

CPA stands for Qualified Public Accounting professional, a designation for people that are licensed by their state boards of book-keeping and have passed the Attire CPA Assessment. While Certified public accountants are commonly linked with tax obligation prep work, they may additionally provide an array of services such as financial planning or bookkeeping. What Function Do CPAs Have in Taxes?

Business Tax Accountant Utah Can Be Fun For Everyone

While all Certified public accountants are accountants, not all accountants are CPAs. business tax accountant utah. A CPA is a cpa who has fulfilled particular state as well as education licensing requirements and passed the Certified Public Accountant test; thus, it's an extremely popular accounting classification. So what are the major distinctions in between CPAs as well as accounting professionals? Why would certainly a Certified Public Accountant designation be beneficial to your job? Below's a look at 4 distinctions in between CPAs and also accountants.

Licensing Certified public accountants have passed extensive screening as well as rigorous requirements for licensing in the state in which they mean to exercise. After college graduation and a year of experience under the guidance of a Certified Public Accountant, prospects should pass an extensive examination of organization, tax obligation, auditing, as well as basic audit abilities.

2. Fiduciary Duty Many organizations that are needed to have an economic declaration audit or evaluation will certainly require a CPA to perform these solutions as well as release the called for records. On top of that, CPAs are taken into consideration fiduciaries with a lawful obligation and also power to act upon part of, and also in the most effective passion of, their customers.

State Demands and Codes of Values The permit is not the only need to be a Certified Public Accountant. Capella University offers an and a, permitting you to tailor your program to your state's CPA requirements.

The Of Business Tax Accountant Utah

In short, CPAs are the 2. If you are wondering what can a CPA do that an accountant ca n'tthese are 2 functions that Certified public accountants are licensed to carry out which normal accounting professionals are not.

Carrying out audits as well as evaluations, Certified public accountants are likewise able to submit records with the Stocks as well as Exchange Compensation (SEC). This is an additional point that normal accountants can not do.

Not known Facts About Business Tax Accountant Utah

Once more, nevertheless, a Certified Public Accountant may have the ability to much better manage tax returns if they are complicated, as their understanding of the tax codes is much more extensive. Besides this, a CPA is also legitimately acknowledged by the IRS. This suggests they can represent your service in any type of potential disagreements with the IRS (more on this listed below).

These can after that be used to balance out the gain and minimize your tax obligation worry. Tax preparation techniques such as this can save a business or private significantly in taxes over time. Last but not least, besides saving you monetarily, wise tax preparation also makes sure that you and your company are running in a tax certified way whatsoever times (business tax accountant utah).

This is one more function that only they can supply, as they are legally acknowledged by the IRS. If you enter right into a dispute with the Internal Revenue Service, having a CPA represent you can be vital. Because Certified public accountants have a detailed understanding of tax laws, they will certainly be more able to protect your situation.

In the exact same method, having a Certified Public Accountant ups your chances of effectively dealing with a tax conflict. Certified public accountants aren't the only individuals that can carry out this role.

|

The Greatest Guide To Business Tax Accountant Utah

Table of ContentsSome Known Details About Business Tax Accountant Utah The Single Strategy To Use For Business Tax Accountant UtahThe Definitive Guide for Business Tax Accountant UtahThe 4-Minute Rule for Business Tax Accountant UtahUnknown Facts About Business Tax Accountant Utah

If you are questioning what can you do with a CPA that you can't with a normal account, this is another area where Certified public accountants are usually the very best option. What Does a CPA Do? Currently You Know In practice, a Certified public accountants typically carry out most of the same points that a non-licensed accountant might do.

Right Here at Pacific Accountancy Group, we offer CPA advice and solutions that you can rely on. Our group of CPAs operates to a superior level of responsibility and quality.

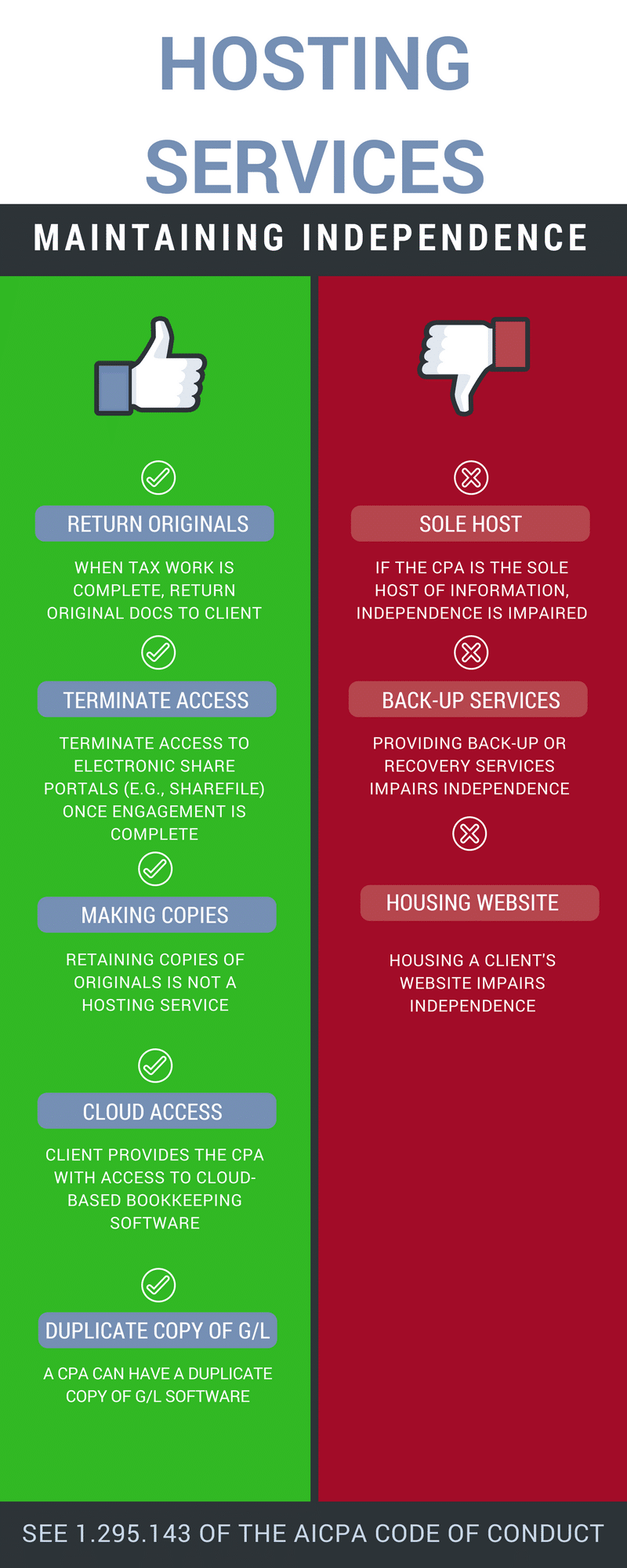

Testimonial as well as give consultation on compensation, advantages, possessions and spending of firm cash. Manage Accounts Payable and Accounts Receivable. Keep up to day on changes in the money sector as well as federal government policy. Guarantee the company updates plans or treatments to adjust. Although the above listings a number of responsibilities of a Certified Public Accountant, it is necessary to keep in mind that Certified public accountants ought to not offer services where they both audit and also speak with for the same company, in order to avoid conflicts of interest.

What Does Business Tax Accountant Utah Do?

For instance, in Canada a "CPA" designation exists, but it means "Chartered Professional Accounting Professional". business tax accountant utah. Is a Certified Public Accountant Better Than an Accountant? A CPA is better certified than an accounting professional to perform accounting obligations, and recognized by the government as someone who is qualified and also a specialist in the area.

Typically, they are also far better paid. business tax accountant utah. A Cpa is allowed to perform particular obligations that normal accountants are not permitted to do, such as preparing an audited financial declaration, or functioning as a taxpayer or company representative in conversation with Internal Revenue Service Income Officers or Guidance. An accountant without the Certified Public Accountant classification can refrain from doing any of these things.

The Institute thinks the development rate of CPAs, which they calculate at 1%, is too low. business tax accountant utah. The Bureau of Labor Statistics (BLS) predicts the work of accountants (not CPA particular) to expand 10% from 2016 2026. Given that the ordinary development rate for all line of work is 7%, this number is taken into consideration to be exceptional.

What Is the Typical Income of a CPA? According to the Journal of Accountancy, the ordinary income of a CPA in the USA in 2017 was $119,000. This figure does not consist of perks or various other advantages. The Journal keeps in mind that: CPAs with much less than one-year experience make approximately $66,000 annually.

How Business Tax Accountant Utah can Save You Time, Stress, and Money.

Can You Get a CPA Without an Accounting Degree? Every state has different certifications for accreditation, all of them need a degree with a particular number of hours dedicated to the study of accounting.

The test is thought about tough as well as candidates should score at the very least 75% in every component. Certified public accountants need to complete proceeding education and learning each year after receiving their classification, in order to keep it. Usually an examination is the last step in the procedure of getting a Certified Public Accountant, however there are a handful of States, like Alabama, that allow a prospect to locate as well as acquire the essential work experience after finishing the examination.

How Long Does It Take to End Up Being a CPA? The length of time it takes to come to be a CPA will certainly depend on the individual situation of the candidate, their degree of education, the state they live in as well as the state's credentials.

Taking into consideration the average length of time it requires to attain the called for degree as well as work experience, it will likely tackle ordinary 6 years to attain the CPA classification, if starting from scratch.

The Facts About Business Tax Accountant Utah Uncovered

A public accountant may be certified as a Certified Public Accountant. Personal accountants do not require qualification, yet there are qualifications readily available such as the Licensed Administration Accounting Professional, Certified Inner Auditor, and Qualified Fraud Supervisor. Actions to a Public Bookkeeping Duty Public accountants require comprehensive experience as well as certifications to exercise as a Certified Public Accountant.

Making a Certified Public Accountant accreditation is essential for public accountants, as well as they can just pursue it after finishing an advanced level. While the Attire CPA Examination coincides in every state, each state has its very own collection of education and also experience needs that people have to meet in enhancement to passing the test.

Find out exactly how to end up being an accountant at Motorcyclist today.

The terms "accountant," "accounting professional," and "CPA" are usually used interchangeably. These 3 specialists are really various in their scope of work, the jobs they execute, their licensing and professional status, and their standing with the Internal Revenue Solution.

7 Easy Facts About Business Tax Accountant Utah Shown

Just Certified public accountants, tax attorneys, and also Enrolled Agents have the ability to represent a taxpayer before the Internal Revenue Service. What Cpa (Certified Public Accountants) Do A CPA has an additional degree of credibility and also know-how. A CPA is an accounting professional who has actually passed particular assessments and satisfied all other legal as well as licensing demands of a state to be licensed by that state.

|

Business Tax Accountant Utah - The Facts

Table of ContentsLittle Known Facts About Business Tax Accountant Utah.The Business Tax Accountant Utah PDFsBusiness Tax Accountant Utah - TruthsHow Business Tax Accountant Utah can Save You Time, Stress, and Money.

People who have actually been awarded the Certified Public Accountant however have actually lapsed in the satisfaction of the required CPE or who have actually requested conversion to non-active standing remain in numerous states permitted to use the classification "Certified Public Accountant Non-active" or a comparable phrase (business tax accountant utah). In the majority of U.S. states, just Certified public accountants are legitimately able to give attestation (including bookkeeping) opinions hop over to these guys on monetary statements.State legislations differ extensively pertaining to whether a non-CPA is also allowed to use the title "accountant." For example, Texas restricts making use of the classifications "accounting professional" and also "auditor" by an individual not certified as a Texas CPA, unless that person is a CPA in one more state, is a non-resident of Texas, and otherwise fulfills the needs for technique in Texas by out-of-state Certified Public Accountant companies as well as practitioners.

In Australia, the term "CPA" is an acronym for Qualified Practising Accounting Professional. To acquire a CPA Australia, it additionally needs a certain amount of education and also experience to be qualified working in some particular locations in the accountancy field.

Districts in Canada likewise enable non-accounting majors as well as worldwide candidates to fulfill the demands if they get right into the CPA Prerequisite Education And Learning Program (CPA PREPARATION) - business tax accountant utah. People in the Philippines register for the Certified Public Accountant need to follow some policies in the act supplied which is recognized Philippine Book-keeping Act of 2004 after that.

Some Of Business Tax Accountant Utah

In 1660, the first person that would certainly conduct an audit was chosen in order to be able to handle the money that was increased by England in Virginia, United States. With the assistance of legal accounting professionals from England and Scotland for training Americans to discover the treatments of accountancy, many firms were developed in America.

On July 28, 1882, the Institute of Accountants as well as Bookkeepers of the City of New York became the very first audit company which supports the demand of individuals in the audit area and also for instructional objectives. With the book-keeping and also market growing in the world, the requirement of searching for services from specialist accounting professionals who had greater criteria as well as were recognized had actually been considered - business tax accountant utah.

These CPAs do not supply services straight to the public. business tax accountant utah. This event resulted in many audit firms unloading their consulting divisions, yet this fad has actually because turned around.

Although the majority of private CPAs who function as specialists do not additionally work as auditors, if the Certified Public Accountant company is auditing the very same business that the company also does consulting benefit, after that there is a conflict of passion (business tax accountant utah). This conflict nullifies the CPA firm's independence for several factors, including: (1) the Certified Public Accountant company would be auditing its own job or the job the company suggested, and also (2) the Certified Public Accountant firm may be pressed right into unduly providing a favorable (unmodified) audit opinion so as not to threaten the consulting revenue the firm receives from the customer.

Not known Factual Statements About Business Tax Accountant Utah

Several tiny to mid-sized companies have both a tax obligation and also a bookkeeping department. Along with attorneys as well as Enrolled Agents, CPAs may represent taxpayers in issues before the Internal Profits Solution (IRS). Although the IRS regulates the practice of tax obligation representation, it has no authority to control income tax return preparers. Some states likewise enable unlicensed accountants to work as public accountants.

Nonetheless, official site the California Board of Accountancy itself has actually established that the terms "accountant" and also "accountancy" are misinforming to participants of the public, several of whom believe that a person who utilizes these terms should be accredited. As part of the California Survey, survey research study revealed that 55 percent of Californians believe that a person that markets as an "accountant" has to be licensed, 26 percent did not think a permit was called for, and also 19 percent did not know. business tax accountant utah.

Some universities provide a 5-year consolidated bachelor's/ master's degree program, enabling a trainee to make both levels while getting the 150 hours needed for test qualification. (questions not customized to the differences of any kind of specific state) and some federal laws.

The Best Guide To Business Tax Accountant Utah

Other states have a one-tier system wherein a person would certainly be certified and also accredited at the same time when both the CPA examination is passed as well as the work experience need has actually been fulfilled. business tax accountant utah. Two-tier states consist of Alabama, Florida, Illinois, Montana, and also Nebraska. The fad is for two-tier states to progressively relocate towards a one-tier system.

The experience part varies from state to state: The two-tier states typically do not need that the person have work experience to get a Certified Public Accountant certificate.

A raising number of states, however, consisting of Oregon, Virginia, Georgia and also Kentucky, accept experience of a much more basic nature in the accounting area. In Texas, just one year of experience in audit under the guidance of a CPA is needed; such experience does not need to remain in public audit.

|

Business Tax Accountant Utah for Beginners

Table of ContentsBusiness Tax Accountant Utah - The FactsThe Facts About Business Tax Accountant Utah RevealedNot known Factual Statements About Business Tax Accountant Utah Business Tax Accountant Utah - Questions

Most of these accept the AICPA self-study Specialist Principles for Certified Public Accountants CPE training course or one more program as a whole professional values. Several states, nonetheless, need that the ethics course consist of an evaluation of that state's details policies for expert practice. Proceeding expert education [modify] Like various other specialists, CPAs are required to take proceeding education training courses toward proceeding specialist advancement (proceeding expert education [CPE] to restore their license.Common factors include these: Permitting the license to gap without renewing in a timely way - business tax accountant utah. Carrying out attestation solutions under an unlicensed/unregistered CPA company or under a CPA firm permit which has click for more actually ended. Continuing to hold up as an energetic CPA on an ended license, which consists of proceeded use of the Certified Public Accountant title on business cards, letterhead, office signs, communication, and so on